The Rise of Mobile Banking

Convenience at Your Fingertips

Mobile banking has revolutionized how we manage our finances, offering unparalleled convenience and accessibility.

With smartphones becoming an integral part of our lives, mobile banking is rapidly gaining popularity. Let's explore the rise of mobile banking and its benefits.

- Accessibility and Convenience: Mobile banking allows customers to access their accounts and perform transactions anytime, anywhere. Whether you're traveling or at home, you can manage your finances with just a few taps on your smartphone.

- Real-Time Notifications: Mobile banking apps provide real-time notifications for transactions, helping customers stay on top of their finances.

This feature enhances financial management and helps detect unauthorized activities promptly.

- Secure Transactions: Mobile banking apps use advanced security features such as fingerprint recognition, facial recognition, and encryption to protect customer data. These measures ensure that your financial information remains secure.

- Wide Range of Services: From checking account balances to applying for loans, mobile banking apps offer a wide range of services. Customers can perform nearly all banking activities through their smartphones, making banking more convenient than ever.

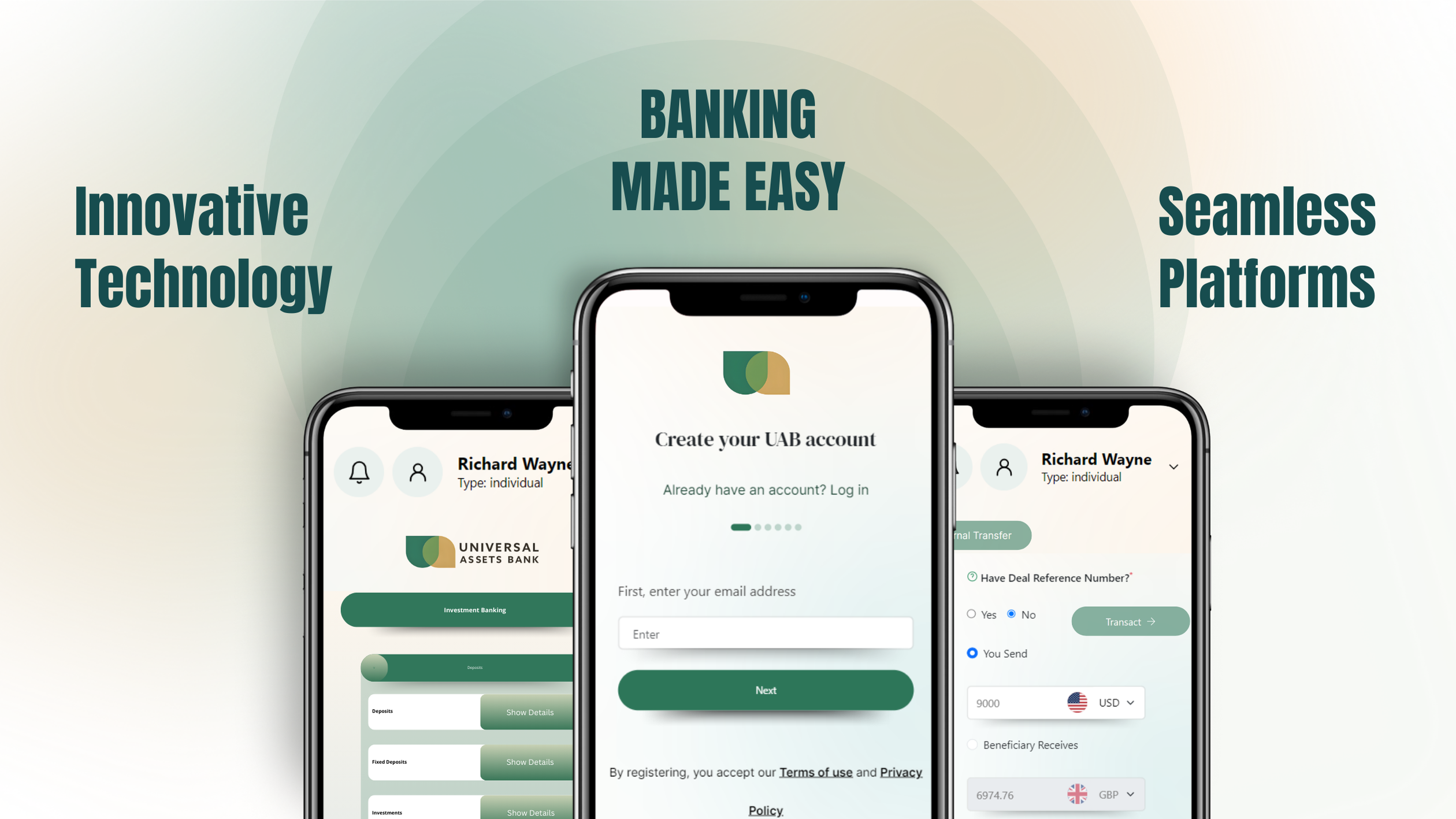

Universal Assets Bank's Mobile Banking Solutions

At Universal Assets Bank, our mobile banking app provides seamless and secure access to your accounts.

With real-time notifications, advanced security features, and a wide range of services, our app ensures a superior banking experience.

As mobile banking offers unparalleled convenience, real-time notifications, secure transactions, and a wide range of services.

Universal Assets Bank is committed to providing a top-notch mobile banking experience, making banking easy and accessible for our customers.

Related Articles

Cybersecurity in Digital Banking

Safeguarding the Future of Finance In an era defined by rapid digital transformation, cybersecurity has become the cornerstone of trust in digital banking. As financial institutions transition to online-first or digital-native models, the volume of ...The Rise of Digital Identity in Financial Services

In today’s increasingly digital world, identity verification has become a cornerstone of modern financial services. The transition from traditional paper-based identification to digital identity solutions is revolutionizing how banks, fintech ...Core Banking System Modernization in Financial Innovation

As financial institutions face increasing pressure to deliver seamless digital experiences, the modernization of core banking systems has become essential. Legacy banking systems, built decades ago, struggle to meet the demands of today's rapidly ...Why Is Borderless Banking the Future of Finance?

Banking without the constraints of geographical boundaries In today’s interconnected world, the demand for borderless banking is surging as businesses and individuals navigate a globalized economy. Borderless banking refers to financial systems and ...The Rise of Embedded Finance

How Non-Financial Companies Are Revolutionizing Banking Embedded finance is quietly transforming the way consumers and businesses interact with financial services. By integrating financial products such as payments, lending, and insurance directly ...